Return on equity (ROE) is an indicator for evaluating a company's profitability and the efficiency of its management. Toyota's recent results briefing featured a discussion of why the company has set its sights on 20%

On February 5, Toyota held its financial results briefing for the third quarter of the year ending March 2025, drawing the following question from reporters:

“ROE is a key financial indicator for investors. How is Toyota planning to boost ROE, and to what level?”

Return on equity, or ROE, is calculated as net income—a company’s year-end profits—divided by shareholders’ equity* and expressed as a percentage.

*Capital which the company is not obligated to repay (accumulated profits, funds raised from shareholders, etc.)

How efficiently does the firm generate profits, using the funds entrusted to it by shareholders? ROE is seen as an important financial indicator for assessing a company’s profitability and the efficiency of its management.

Accounting Group Chief Officer Masahiro Yamamoto prefaced his response with an apology—“This might take a while…”—before explaining what ROE means to Toyota, and retracing the progress made since the global financial crisis.

Chief Officer Yamamoto

I believe our most important objective is to complete Toyota’s transformation into a mobility company.

ROE is an important financial indicator, and a yardstick for checking how well we are progressing toward that goal.

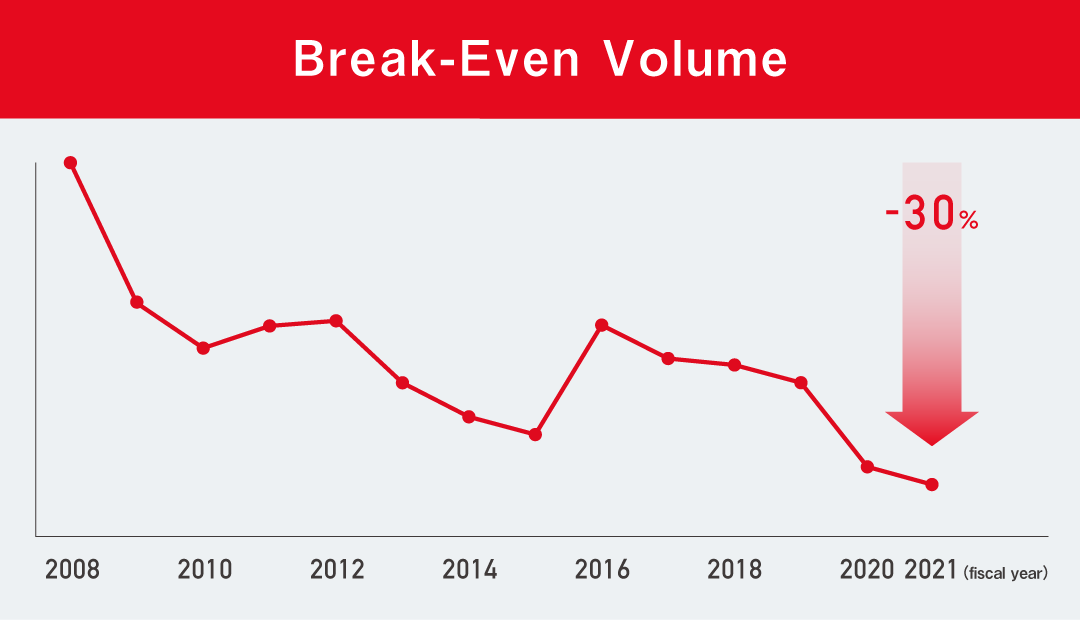

At one point in the past, Toyota fell into the red and was on the verge of collapsing.

President Akio Toyoda (at the time) vowed that “we must survive at all costs” and “restore Toyota once again.” He set about establishing solid financial foundations that would enable us to make “ever-better cars.”

At the time, the company had little cash on hand, a very high break-even volume, and a structure that struggled to deal with change.

From that point, we were determined not to fall into the red again and brought the company to where it is today.

We were able to establish the financial foundations for sustainable growth, which I believe was thanks to our genba’s tremendous ability to get the job done.

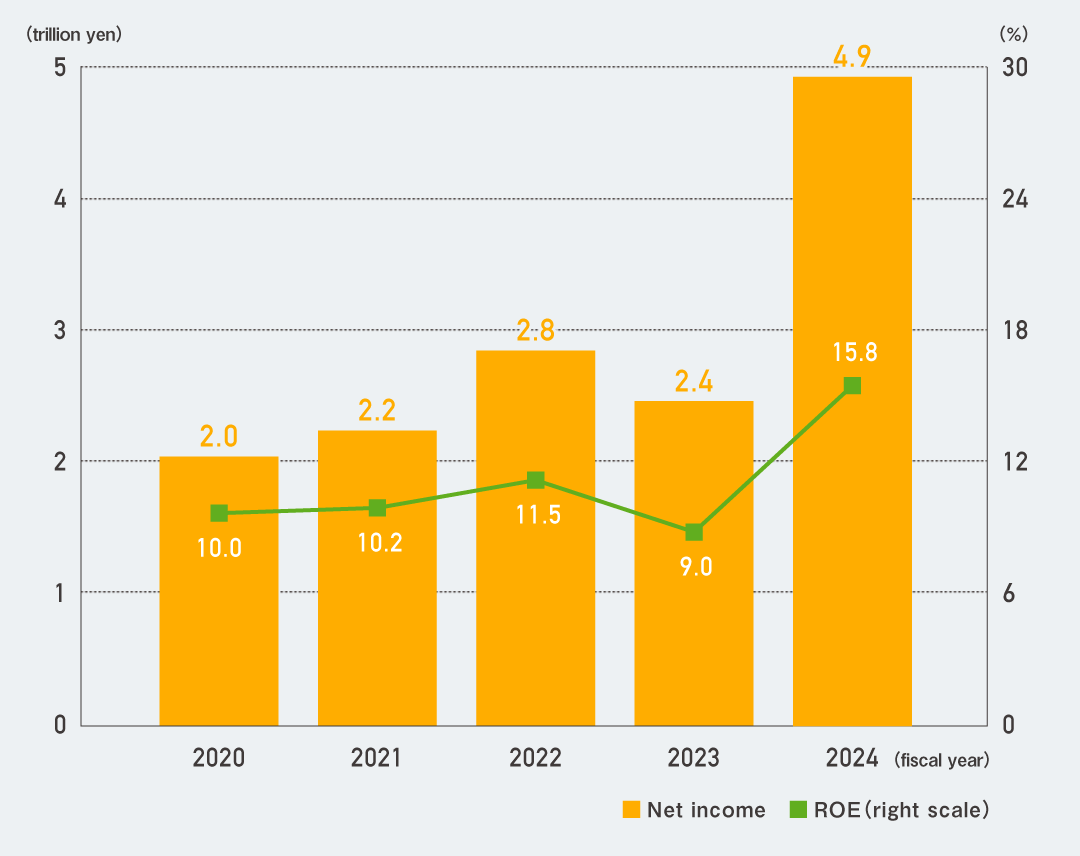

I also believe that consistently delivering an ROE above 10% is extremely important.

With these foundations in place, our next challenge is to transform Toyota into a mobility company.

While we do not yet have the right answers, I believe that this financial footing is what allows us to tackle challenges without fear of failure, to say, “It’s okay to fail.”

Our duty as a carmaker is to continue striving to produce happiness for all and to ensure that cars enhance our customers’ lives and the value of mobility for society as a whole.

These new changes will be intertwined with challenges such as Woven City.

At its core, I believe the E (denominator) in ROE is about human resources, us, the people of Toyota.

It is also connected to the TPS (Toyota Production System) mindset: using knowledge and ingenuity to make improvements, raise productivity, spark innovation, and take on new challenges.

People are not a “cost,” but rather the source of a company’s earnings, and I feel that this is the “E” component to which we should turn our attention.

Redistributing our assets within our various new businesses will serve to improve ROE, which I consider to be like a mirror that allows us to see whether we are transforming into a mobility company.

In this sense, we regard ROE as an extremely important indicator.

Pressed to give a target figure, Chief Officer Yamamoto responded, “At present, we are consistently above 10%, and we want to ensure we maintain that. At the same time, we are aiming for 20%.”

A return on equity of 20% is a very high mark for the manufacturing sector and would make Toyota one of the top performers among the world's leading car companies.

To achieve this, the company must shift from a business of one-off transactions, where earnings come from selling new cars, to one that generates ongoing revenues after vehicles are sold. In other words, Toyota needs to transform its existing business model.

This is what Chief Officer Yamamoto meant when he spoke of a “yardstick” for checking the company’s progress.

And this transformation will be underpinned by Toyota’s human resources. As Yamamoto pointed out, the shareholders’ equity that forms the ROE denominator includes the company’s personnel, which is “us, the people of Toyota.”

As Toyota seeks to transform itself into a mobility company, will its people be a “source of earnings,” rather than a “cost?” That is the challenge for each and every employee.